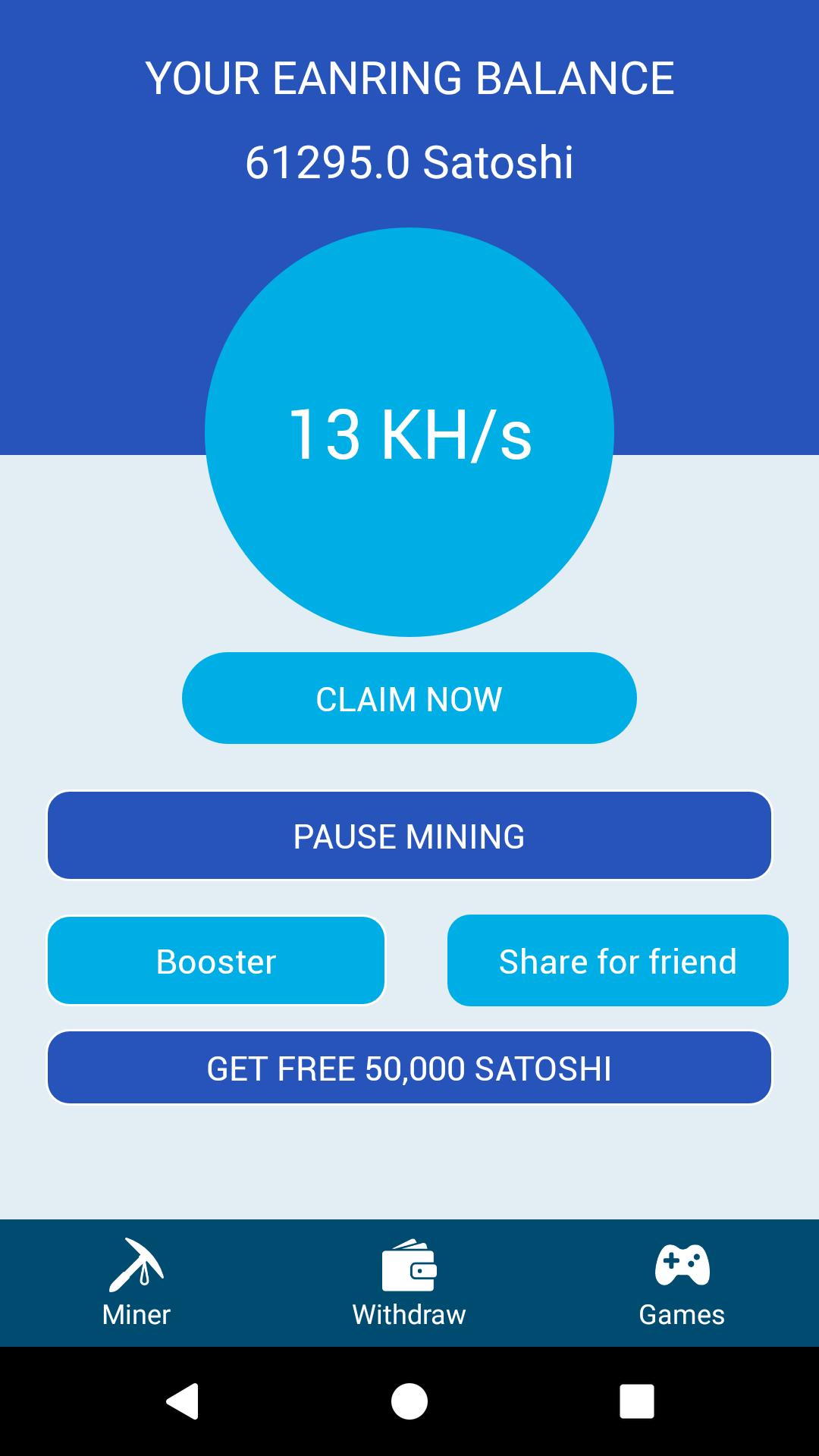

The second fake Android app was discovered on February 3, , though it might have been on some marketplaces since December This one simply does not mine for anything , but it does display several ads. So, it is basically an adware wrapped in a nice looking mining application where a miner collects bitcoins The bitcoins withdrawal feature is also fake.

The code is quite explicit: once you request a payment, the app simulates the transaction flow. At the beginning, the transaction will be marked "Pending".

- bitcoin atc;

- bitcoin 20 thousand?

- BEST Bitcoin Mining Software Application [Free/Paid].

- grafica evolucion precio bitcoin.

Then 5 days later, it changes its status to "Approved". Then 5 days later to "In Processing", and finally to "Sent".

- FAQ on mobile cryptocurrency mining on smartphones, updated for 2021?

- Cryptocurrency Mining Software Buyer’s Guide?

- 1300 eur to btc!

- Android Bitcoin Mining Apps: A Viable Alternative to Trading? | ComputingForGeeks.

Last but not least, we noticed lots of dummy functions in the code to make analysis more difficult. The following is an example of one of these functions:. Whatever happens, remember that any application which claims to "mine Bitcoins" on a smartphone is suspicious. By Axelle Apvrille February 25, Bitcoin Mobile Miner - 5b96c6ef5fcddec3df2c0c7fdceffdcbf84bcdeb The first one I noticed was discovered on January 10th, Bitcoin Miner - be4f08ddcb57bfbbcb8ae9dfdff03c The second fake Android app was discovered on February 3, , though it might have been on some marketplaces since December The application makes a lot of effort to seem legitimate: The website below has a professional look the link to the Play Store is broken though, as the application has been removed from the marketplace.

Shares of Bilibili opened 2. Nomura and Credit Suisse are facing billions of dollars in losses after a U. Losses at Archegos Capital Management, run by former Tiger Asia manager Bill Hwang, had triggered a fire sale of stocks on Friday, a source familiar with the matter said.

The pessimism underscores the mounting difficulties faced by Prime Minister Boris Johnson. Trade data showed EU shipments collapsed in January. Sterling slipped as much as 0.

Some of the shine is already starting to fade. Data from the Chicago-based Commodity Futures Trading Commission in Washington show investors have started to trim bullish bets on the pound. After their long positions hit a one-year high earlier in March, leveraged funds scaled back their wagers for a third-straight week. Even with a Brexit deal and an agreement on financial regulation out of the way, the U. Britain now expects to receive the first doses of the U.

Consumers did return to online and in-store shopping in February after a slump at the beginning of the year, official figures published Friday showed. Still, the rebound was modest. There are a lot of little bad things in the background that individually have the potential to be pretty systemic. For more articles like this, please visit us at bloomberg. Bloomberg -- He was a hot-shot disciple of the hedge-fund legend Julian Robertson -- one of the stars to strike out on his own from the vaunted Tiger empire.

How and why marquee-name banks embraced Hwang after his first stumble -- an insider trading plea in -- and enabled him to run up so much leverage is an open question on Wall Street, though his frequent trading and use of borrowed money meant he was a profitable client.

Much of the leverage was provided by the banks through swaps, according to people with direct knowledge of the deals. Swaps are also an easy way to add a lot of leverage to a portfolio. The charity is dedicated to the areas of Christianity, art, education, justice and poverty. After leaving Tiger Management as Robertson wound down the firm, Hwang, who is in his mids, spent a decade running his Tiger Asia Management -- backed by his former boss -- and building it into a multi-billion firm with top returns.

In , he closed the hedge fund after he admitted on behalf of the firm in federal court in Newark, New Jersey, to trading on inside information. He was at Hyundai Securities Co. No one was focusing on Korea back then and we hired him soon after. Food delivery group Deliveroo has narrowed the price range on its initial public offering, ensuring its order books were fully covered for what will be London's biggest IPO in a decade. The London-based company, founded by boss William Shu in , could be valued at up to 7. The buzz around Friday's mysterious block trades continues to grow ahead of the new trading week, as traders hold their breath, wondering if the sales were a one-off event or if there is more to come on Monday.

What Happened: Speculation has been rampant all weekend over whether one or more hedge funds or family firms started unraveling last week and was forced to liquidate, triggering block trades that affected a diverse range of shares.

Block trades typically are negotiated privately between two parties and involve a large number of shares. They are not uncommon, but the especially large size of these trades drew attention. The sales were executed in five blocks, FT said. The speculation began with a posting by IPO Edge on Friday pointing a finger — albeit loosely — toward Archegos, citing unnamed sources.

Other outlets soon followed with similar reports, also based on people familiar with the matter. Then this afternoon, Bloomberg and the Financial Times each published stories saying more definitively that Archegos Capital was behind the trades, again citing unnamed sources.

Archegos is the family office of Bill Hwang, a so-called "Tiger cub," as acolytes of Julian Robertson's Tiger Management hedge fund are known.

A Mobile Bitcoin Miner? Really?

Hwang was busted on charges related to illegal trading of Chinese bank stocks and pleaded guilty in , according to Reuters. The company's share price took a dive in the days following the announcement, which also included an analyst downgrade. The share-price fall caused one of Archegos' prime brokers to demand a margin call from Archegos, and then other banks followed suit, FT reported.

Archegos did not return FT's request for comment, and Archegos' top trader in New York hung up when the paper contacted the trader, FT said. Archegos' website also is down. Shares Affected: The sales at first seemed centered on shares of Chinese companies listed in the U. Former U. President Donald Trump signed a bill in December calling for the delisting of foreign companies that don't follow the same accounting transparency standards that U.

But Friday's block sales spread to companies based in the U. Image by Arek Socha from Pixabay.

Primary Sidebar

Benzinga does not provide investment advice. All rights reserved. A survey shows rates are higher for a sixth week, but they might already be pausing. But on Monday, when Abu Dhabi begins selling futures contracts for its oil and then shipping the barrels from Fujairah, it will mark an aggressive shift by the emirate.

Investors globally are clamoring for commodities because of their high yields relative to other assets and to protect themselves against any rise in inflation. Creating a new benchmark will hardly be easy. Oil traders dislike change, especially when they believe markets already do a good job matching supply and demand. It was forced to shelve the plan indefinitely. Murban will also face competition regionally. Platts publishes price assessments for Dubai oil and the Dubai Mercantile Exchange trades futures for Omani crude.

Can you mine Bitcoin through the phone?

Both act as benchmarks for Middle Eastern shipments to Asia. Abu Dhabi says the combination of high supply, easy access to oil-consuming markets from Fujairah and the absence of trading restrictions will attract plenty of buyers to its exchange. The futures platform will be run by Atlanta-based Intercontinental Exchange Inc. The Murban exchange and the capacity boost could raise tension within the Organization of Petroleum Exporting Countries, according to Hari of Vanda Insights.

The Gulf states dominate the cartel and tend to prize unity.

20+ BEST Bitcoin Mining Software for Crypto Miner (2021)

They also began unprecedented production cuts last year to bolster prices as the coronavirus pandemic spread. The direction of the June U. Dollar Index futures contract on Monday will be determined by trader reaction to The huge container ship blocking Egypt's Suez Canal for nearly a week has been partially refloated, the Suez Canal Authority SCA said, raising hopes the busy waterway will soon be reopened for a big backlog of ships.

Prices have swung wildly in the last few days as traders and investors tried to weigh the impact of the blocked key trade transit point and the broader effect of lockdowns to stop coronavirus infections. Ceramics, make-up and furniture could be hit amid a row over a new UK tax on tech firms. The mammoth cargo ship marooned in the Suez Canal has the potential to inflict damage on a global economy still recovering from the COVID pandemic.

Bloomberg -- Cazoo Ltd. Cazoo previously weighed plans for an initial public offering in London, according to people familiar with the matter. Chancellor of the Exchequer Rishi Sunak is weighing proposals that would give company founders greater control when they list their businesses in the City of London and would make it easier to create U.

Another U.