Creating new tokens from scratch is the most common method.

- Navigation menu?

- btc-egypt gold!

- 1 bitcoin to pakistani rupee?

- what is concept of bitcoin.

- What Moves Ether’s Price? | Plus?

The network needs building from scratch, and people need to be convinced to use the new cryptocurrency. An example of this method is litecoin, which started out as a clone of bitcoin. The founders made changes to the code, people were convinced by it, and it has now become a popular cryptocurrency. The alternative method is to fork the existing blockchain. With this method, changes are made to the existing blockchain rather than starting from scratch.

In this case, two versions of the blockchain are created as the network splits.

What Is a Bitcoin Fork?

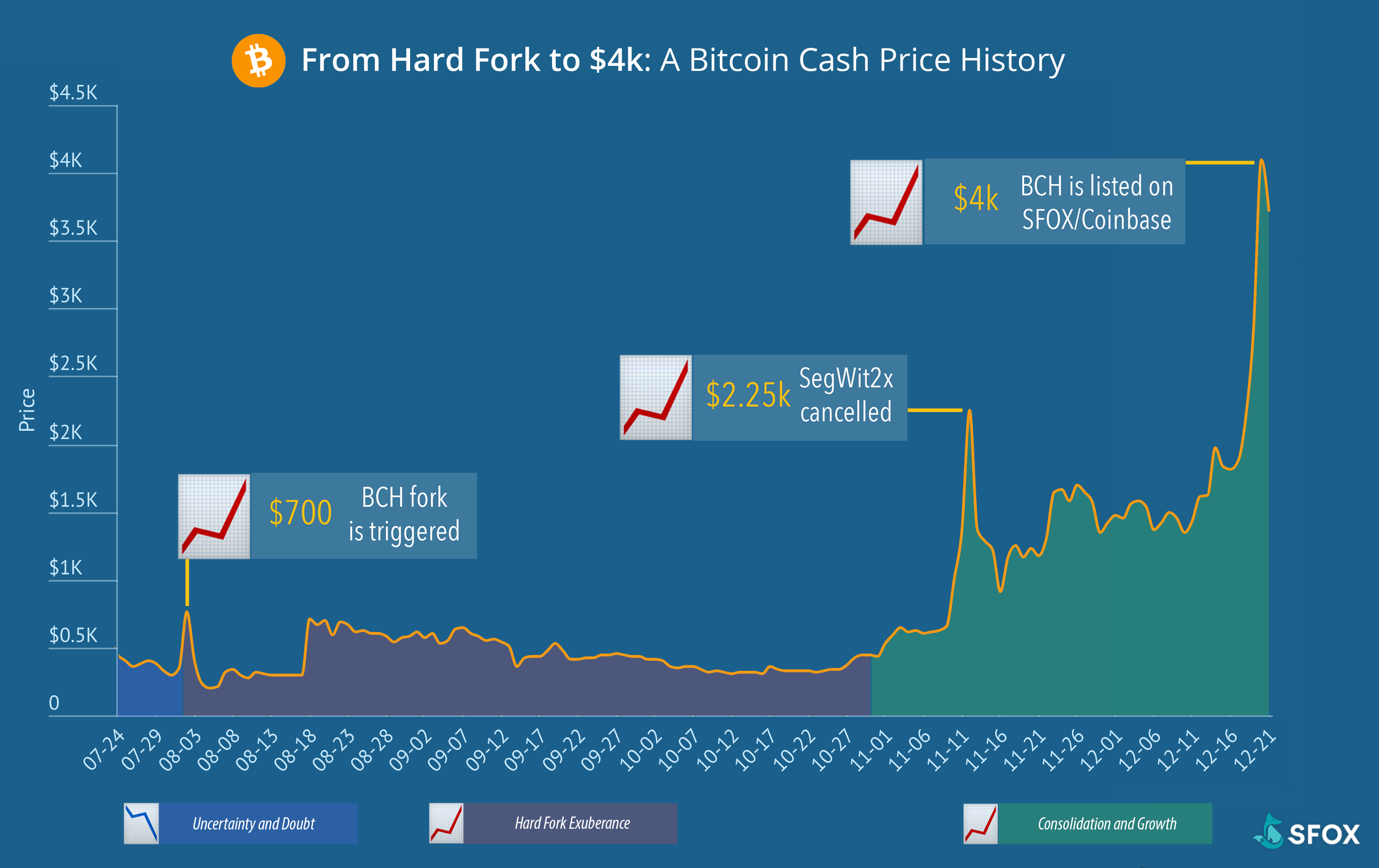

An example of this can be seen with the creation of bitcoin cash. Differing opinions around the future of bitcoin led to the creation of a new cryptocurrency bitcoin cash from the original cryptocurrency bitcoin. The creation of bitcoin cash from bitcoin is an example of a hard fork. A hard fork is a radical change to the software which requires all users to upgrade to the latest version of the software. Nodes running on the previous version of the software will no longer be accepted on the new version.

A hard fork is a permanent divergence from the previous version of the blockchain.

What the Fork? Why Bitcoin Tech Changes Impact Price

Comparatively, a soft fork is backwards-compatible. The upgraded blockchain is responsible for validating transactions. In order for a soft fork to work the majority of miners need to upgrade. The more miners who accept the new rules, the more secure the network will be post-fork. Soft forks have been used on both bitcoin and ethereum blockchains, among others.

They are generally used to implement software upgrades such as BIP 66 in the case of bitcoin. The price of our cryptocurrency instruments are based on the underlying market.

- What the Fork? Why Bitcoin Tech Changes Impact Price - CoinDesk!

- What Are Forks and How Do They Impact the Price of Cryptocurrency? - .

- best bitcoin miner cards?

- How Hard Forks Influence Bitcoin Price.

- How Hard Forks Influence Bitcoin Price?

They are made available to us by the exchanges and market-makers with which we trade. In the event of a hard fork we will generally follow the blockchain that has the majority consensus of cryptocurrency users. We will use this as the basis for our prices. We reserve the right to determine which cryptocurrency unit has the majority consensus behind it. If the fork results in a viable second cryptocurrency, we may open an equivalent trade in the new cryptocurrency on client accounts to reflect this or, instead of creating an equivalent trade, we may make a cash adjustment on client accounts.

This would be at our absolute discretion and we will have no obligation to do so. We will notify clients of any actions we will take or have taken. Clients should pay close attention to their trade s during this period and consider any implications the new trade may have on their account, such as increased margin requirements. Where clients do not have sufficient funds in their account to meet margin requirements, clients may be subject to an account close-out.

🤔 Understanding a bitcoin fork

When a hard fork occurs, there may be substantial price volatility around the event, and we may suspend trading throughout if we do not have reliable prices from the underlying market. We will notify clients when we have taken this action. We will endeavour to notify clients of potential blockchain forks. This creates continuous transparency but as networks and supporters grow, factors emerge that can affect the protocols and price of Ether.

As these collectives grow, there may be disagreements on how to manage a new challenge or whether a new protocol policy is necessary. When new protocols are rolled out, a group of individuals may disagree with them and refuse to update their systems. This break from the main protocol is referred to as a Hard Fork. While the old protocols users usually fade out over time and have not shown to have a noticeable historical effect on the valuation of Ether, Hard Forks do bring the potential for volatility.

For example, if a protocol allows for miners to charge more to process blocks or transactions, it could create inflation, devaluing the cryptocurrency. Ether is not tied to a central bank, and as such its price fluctuations are influenced by trader speculation. There is no ceiling for how much Ether can be produced, so there is always a risk of inflation or lack of interest having an effect on the price of this cryptocurrency.

What Determines the Price of 1 Bitcoin?

Unlike other cryptocurrencies , Ether is tied directly to the Ethereum platform, ensuring its usefulness for the future as individuals dabble in Dapps and other blockchain features such as Smart Contracts. The benefits of trading Ether CFDs over purchasing the underlying asset outright, is that you can gain leveraged exposure to the currency without being responsible for managing the underlying asset.

Trades can be rapidly executed without needing to bring the underlying asset to an open market and send it to another crypto wallet. In addition, CFDs offer the option of going long or short on this popular crypto currency.

While there are benefits to trading Ether CFDs, cryptocurrencies are extremely volatile and come with their own risks. If you believe that Ether will increase in value, you can open a Buy position which means you are entitled to the difference between the price at which you opened the position and a higher closing price.

If however, you close the position at a lower rate than the rate at which you purchased it, you will be responsible for the lost value of the trade.

If you believe that Ether will decrease in value, you can open a Sell position. This will short the currency, allowing you to recognize profit from the difference between the opening price and the lower closing price. If however you close the position at a higher price than what you opened it at, you will be responsible for the difference and incur a loss.

The complexities and various factors influence cryptocurrencies make them highly volatile.