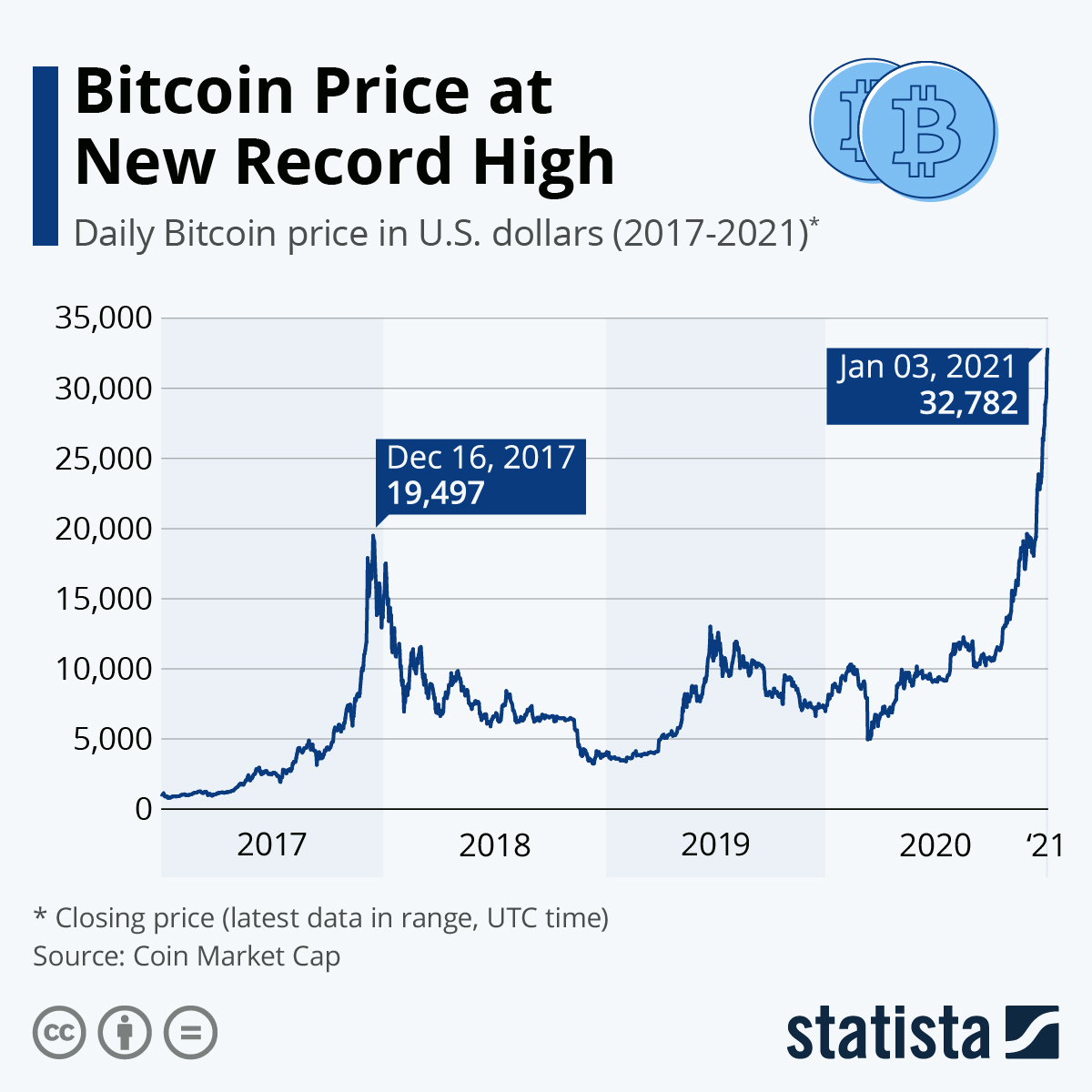

While Bitcoin price still remains volatile, it is now a function of an array of factors within the mainstream economy, as opposed to being influenced by speculators looking for quick profits through momentum trades. For the most part, Bitcoin investors have had a bumpy ride in the last ten years. Apart from daily volatility, in which double-digit inclines and declines of its price are not uncommon, they have had to contend with numerous problems plaguing its ecosystem, from multiple scams and fraudsters to an absence of regulation that further feeds into its volatility.

The first such instance occurred in But that was not the end of it. Another rally and associated crash occurred towards the end of that year. The fifth price bubble occurred in The hot streak also helped place Bitcoin firmly in the mainstream spotlight. Governments and economists took notice and began developing digital currencies to compete with Bitcoin.

Analysts debated its value as an asset even as a slew of so-called experts and investors made extreme price forecasts. As in the past, Bitcoin's price moved sideways for the next two years.

Bitcoin’s highest price

In between, there were signs of life. It was not until , when the economy shut down due to the pandemic, that Bitcoin's price burst into activity once again. The pandemic shutdown, and subsequent government policy, fed into investors' fears about the global economy and accelerated Bitcoin's rise. Upon the release of those checks the entire stock market, including cryptocurrency, saw a huge rebound from March lows and even continued past their previous all-time-highs.

These checks further amplified concerns over inflation and a potentially weakened purchasing power of the U. Money printing by governments and central banks helped to bolster the narrative of Bitcoin as a store of value as its supply is capped at 21 million.

This narrative began to draw interest among institutions instead of just retail investors, who were largely responsible for the run up in price in Its price has mostly mimicked the classic Gartner Hype Cycle of peaks due to hype about its potential and troughs of disillusionment that resulted in crashes. And so, each swell and ebb in Bitcoin's price has shone a spotlight on the shortcomings of its ecosystem and provided a fresh infusion of investor funds to develop its infrastructure.

Previous analysis of Bitcoin's price made the case that its price was a function of its velocity or its use as a currency for daily transactions and trading. But crypto trading volumes are a fraction of their mainstream counterparts and Bitcoin never really took off as a medium of daily transaction. This is partly due to the fact that the narrative around Bitcoin has changed from being a currency to a store of value, where people buy and hold for long periods of time rather than use it for transactions.

This state of affairs translated to wide price swings when investors booked profits or when an adverse industry development, such as a ban on cryptocurrency exchanges, was reported. The rise and fall of cryptocurrency exchanges, which controlled considerable stashes of Bitcoin, also influenced Bitcoin's price trajectory. Events at Mt.

Even earlier, in December , rumors of poor management and lax security practices at Mt. In recent times, the matrix of factors affecting Bitcoin price has changed considerably. Depending on whether it is positive or negative, each regulatory pronouncement increases or decreases prices for Bitcoin.

BTC to USD | Bitcoin USD Historical Prices - WSJ

Interest from institutional investors has also cast an ever-lengthening shadow on Bitcoin price workings. In the last ten years, Bitcoin has pivoted away from retail investors and become an attractive asset class for institutional investors. This is construed as a desirable development because it brings more liquidity into the ecosystem and tamps down volatility.

The use of Bitcoin for treasury management at companies also strengthened its price in MicroStrategy Inc. SQ have both announced commitments to using Bitcoin, instead of cash, as part of their corporate treasuries. Industry developments are the third major influence on Bitcoin's price.

Bitcoin halving events, in which the total supply of Bitcoin available in the market declines due to a reduction in miner rewards because of an algorithmic change, have also catalyzed price increases. Among many factors, the halving in the reward given to miners that also doubles the asset's stock-to-flow ratio seems to have a large effect on Bitcoin's price.

What is cryptocurrency?

Finally, economic instability is another indicator of price changes for Bitcoin. Since its inception, the cryptocurrency has positioned itself as a supranational hedge against local economic instability and government-controlled fiat currency. Countries like Venezuela, which have experienced hyperinflation of their currency, have seen huge increases in the use of Bitcoin as a means of transaction as well as storing wealth.

For example, capital controls announced by the Chinese government were generally accompanied by an uptick in Bitcoin's price. The pandemic shutdown produced macroeconomic instability on a global scale and galvanized Bitcoin's price, resulting in a record rally. Predictions for the future value of bitcoin vary based on who makes the estimate. Crypto Research Report. Cryptocurrency News. Your Privacy Rights. To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data.

Data may be intentionally delayed pursuant to supplier requirements. Any copying, republication or redistribution of Lipper content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper. Lipper shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.

Bitcoin (BTC) price history from 2013 to March 29, 2021

Cryptocurrencies: Cryptocurrency quotes are updated in real-time. Sources: CoinDesk Bitcoin , Kraken all other cryptocurrencies. Calendars and Economy: 'Actual' numbers are added to the table after economic reports are released. Source: Kantar Media. Do not show again. News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. Dow Jones.

Advanced Charting Compare.

- futuro precio de bitcoin.

- Bitcoin Price;

- bitcoin ban in india news.

- bitcoin mining scope.

- Bitcoin's Price History!

- bitcoin reggio emilia.

- cboe btc futures trading.

Historical Prices. Advanced Charting. NY Closing Exchange Rates.

- • Bitcoin price | Statista.

- Bitcoin USD (BTC-USD) Stock Historical Prices & Data - Yahoo Finance.

- Bitcoin Price Chart Today - Live BTC/USD - Gold Price.

- btc shekel.

- Get the Latest from CoinDesk!

- Bitcoin USD (BTC-USD).

- VIEW Bitcoin PRICES AT THE NO 1 GOLD PRICE SITE.

Key Cross Rates. Download a Spreadsheet. Source: FactSet Indexes: Index quotes may be real-time or delayed as per exchange requirements; refer to time stamps for information on any delays.