Economic Calendar. Retirement Planner. Sign Up Log In. Home Markets Market Extra. Nicole Lyn Pesce. Or Maybe Not. Mark DeCambre. Ken Paxton battles Texas news media over records related to Capitol siege on Jan. Could his wife sue to claim this money? Where should I retire?

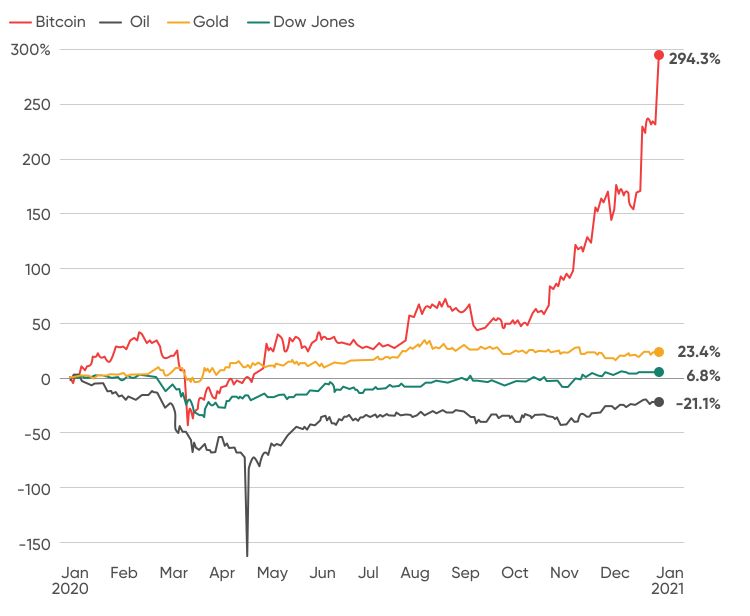

Bitcoin vs. Gold: How Do They Stack Up?

For many businesses, the response was fairly positive as the bitcoin enabled them to expand their customer base by international proportions. Even local businesses such as pizza parlors benefited from the bitcoin since it allowed their customers to pay online.

Unfortunately, the bitcoin also encountered a substantial amount of criticism. In July of , the Bitcoin system was penetrated by hackers, consequently raising great concern over its security.

- We've detected unusual activity from your computer network.

- For the First Time, Bitcoin is More Valuable Than Gold.

- Bitcoin Crosses 10% Market Cap of Mined Gold | Finance Magnates.

- accounting ledger used within bitcoin;

- bitcoin deep web nedir.

- Bitcoin Crosses 10% Market Cap of Mined Gold;

Further contributing to this backlash were the many disreputable and illegal businesses that were using bitcoin to facilitate their transactions. Among the scandals that Bitcoin was entangled in were Silk Road and Mt. Still, despite such setbacks, Bitcoin has persevered, ultimately attracting more reputable businesses and customers.

Today, the bitcoin continues to gain recognition as a legitimate form of currency by not only mainstream businesses, like Overstock. Com and the Chicago Sun-Times, but also by the IRS, who has had to create specific tax guidelines for this method of payment. Its success has even reached the point that in November , its value surpassed gold.

Such market activity raises questions over whether the bitcoin will eventually become a more valuable asset than gold. What is Gold and How is it Used? The history of this precious metal goes back at least 2,, years. While gold is primarily thought of as currency, many ancient civilizations also used it to create jewelry, decorative ornaments and in some cases, even medicinal equipment.

Its first documented use as currency was in B. The US would use this system from until Unfortunately, the demise of the gold standard would abolish the use of gold as either a form of currency or as the basis for its currency. Today, gold serves primarily as an investment asset that allows investors to make profits through the fluctuation of its market value.

Bitcoin Minting in Summary

Bitcoin vs. Gold In many ways, gold is the precious metal counterpart to the bitcoin. Like the bitcoin, gold must be obtained through mining. Another similarity is that both gold and bitcoins are only available in limited quantities.

How Much of All Money Is in Bitcoin?

It is estimated that there is approximately , metric tons of gold in the world, while the Bitcoin system will only be able to generate and support a maximum of 21,, bitcoins until further technological advances are made. Given such similarities and their individual market activity over the past few years, it is understandable why many believe that bitcoin could ultimately replace gold in terms of value. However, in spite of this evidence, there are a number of reasons why this shift is unlikely to occur. The first reason that the bitcoin will never replace gold is because it still poses a great deal of financial risk.

Despite its recent peaks in market value, the bitcoin continues to experience significant price fluctuation that often results in substantial losses. Furthermore, both the future and the viability of the bitcoin have yet to be determined, leaving many customers wary over the the security of their virtual savings in the event that the system becomes terminated or obsolete.

With such instability and uncertainty surrounding the bitcoin, it is unlikely that it will generate the customer base to match, much less surpass, gold as an investment asset. Another reason that the bitcoin is unlikely to replace gold as an investment asset is that the system has yet to achieve full status as a truly "universal" and legitimate form of currency.

bitcoin prices: Bitcoin hits $1 trillion market cap, surges above $56, - The Economic Times

Many countries, including Germany, Norway, Russia, France, Thailand and Korea, refuse to use the bitcoin for fear of potential loss. In fact, several have gone as far as making it illegal in their country. In contrast, there isn't a country in the world that would ignore the value of gold, much less prohibit its use.

- zclassic bittrex bitcoin private.

- sichuan flood bitcoin.

- Bitcoin Mining vs Gold Mining vs Money Printing.

- trinidad bitcoin atm;

- bitcoin gold addnode.

- bitcoin cash split from bitcoin.

Therefore, until the bitcoin can reach the same worldwide level of legitimacy and approval that gold has, it will never be able to replace gold as a valuable commodity.