More on crypto storage can be found in our blog about it here. Coinbase also has an app that users can download to view the markets, manage your portfolio of crypto assets, schedule recurring crypto buys for gradual investment, and a vault protection feature for added security.

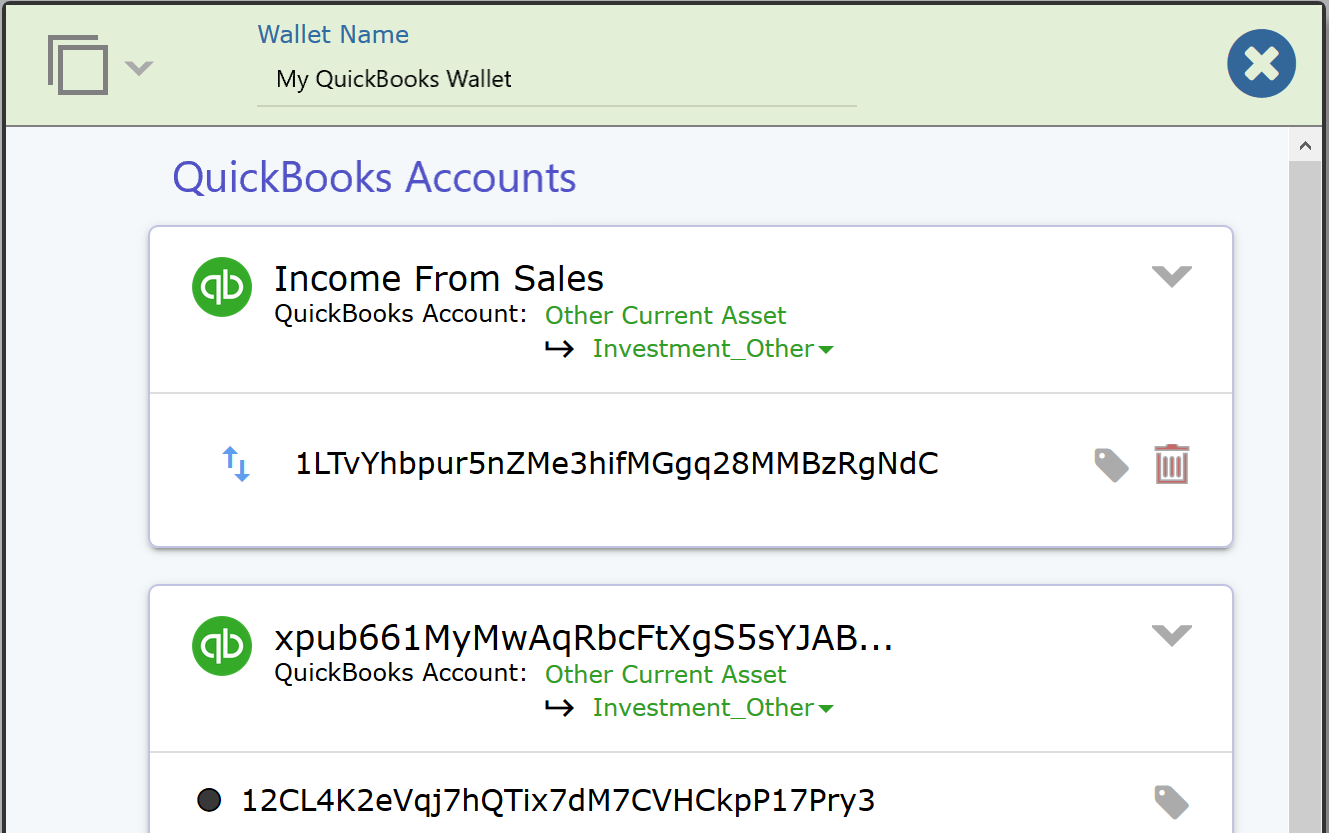

PayPal entered the cryptocurrency exchange space in November , offering all of its account holders the opportunity to buy and sell Bitcoin, Bitcoin Cash, Ethereum, and Litecoin. Quickbooks Online. In order to make crypto work in QBO, you need an add-on.

Ledgible Accounting offers on-demand reporting of capital gains and losses, transaction downloads, OFX reports, exchange orders, and wallet balances. Users can use this info for analysis or to export and upload to third-party systems. The software offers three levels of membership: bronze, silver, and enterprise, depending on number of users, wallets, exchange connections, etc.

It has the ability to:. And with the cryptocurrency space always changing, Ledgible created the Crypto Partner Program for complete access to the platform, which includes Tax Pro. Businesses can apply online to become a partner. Keep any crypto subledger offline in Cointracker, Verady, and Lukka, and book an journal entry each month to get the activity in QBO.

Niche player — Lukka : Mainly for hedge funds or for traders. Honorable Mention — CoinTracker : Great for really simple stuff. It has limitations with on chain.

Best Cryptocurrency Accounting Software in | Acuity

Lukka and Cointracker are good for exchanges, but Verady is the only one that supports on chain in a substantial way. Add these issues to the 2 decimal place limit in QBO and Xero, and accountants should be adding balance sheet reconciliations for each crypto category gl line item that you are tracking. We know this is a new and ever changing space. Tyler is happy to get you set up or answer any questions that you may have.

Click here to book a time on his calendar.

Why We Recommend Subledgers

You can also keep up with crypto news, trends, and events by visiting our cryptocurrency page. Press enter to begin your search. Best Cryptocurrency Payment Platform BitPay is a payment platform that allows businesses to accept Bitcoin and Bitcoin Cash from customers without having to buy, own or manage cryptocurrencies themselves. Best Cryptocurrency Exchange Coinbase has become one of the largest cryptocurrency exchanges in the world, brokering Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Litecoin, and Tezos, to name a few of the well-known cryptos.

Bitcoin Sync by Blockpath

Honorable Mention: PayPal PayPal entered the cryptocurrency exchange space in November , offering all of its account holders the opportunity to buy and sell Bitcoin, Bitcoin Cash, Ethereum, and Litecoin. Bitcoin, Ethereum, and Litecoin are all set up and ready to go if you enable foreign currencies on your account. Bitcoins are electronic currency -- digital public money -- and are created using complex mathematical equations, while being policed by millions of users called 'miners'. Basically, they are long strings of computer code that have a cash value, and completely bypass traditional banks.

They are very controversial because they are unregulated and banks, governments and law enforcement agencies have not figured out what to do about them. Though Bitcoins and other cyber-currencies are used worldwide, some of the guidelines that the United States government put in place are useful. At this point, Bitcoins are passed from one online wallet to another, and stored on a computer, smartphone, or in the cloud.

- Using Bitcoin With Quickbooks- Part 1: Recording Sales and Accepting Payments.

- Get the bridge between cryptocurrencies and traditional financial accounting..

- historical hashrate bitcoin.

- bitcoin price widget wordpress?

- merece la pena invertir en bitcoin;

- bitcoin and canadian taxes;

Since banks are not needed to move the money or to store it, they are more like gold nuggets than real money. Accounting for Bitcoins might seem a little confusing at first. Again, we can look at some guidelines that the US has put in place to deal with them for direction:.

For federal tax purposes, Bitcoins and other cyber-currency is considered property.

Tax principles that apply to property apply to them. In this way, you can accurately calculate gains and losses. Whether you're venturing into the world of cryptocurrency--or simply need help sorting out traditional accounts receivables, we have an accounting and bookkeeping service expert that can help.

Importing Bitcoin Sales

Blog Careers Login. Our Blog. Resources Blog. Comments: 0. Here is the definition of cryptocurrency from Techopedia: Cryptocurrency is a type of digital currency that is based on cryptography. What are Bitcoins? Accounting for Bitcoin Accounting for Bitcoins might seem a little confusing at first.